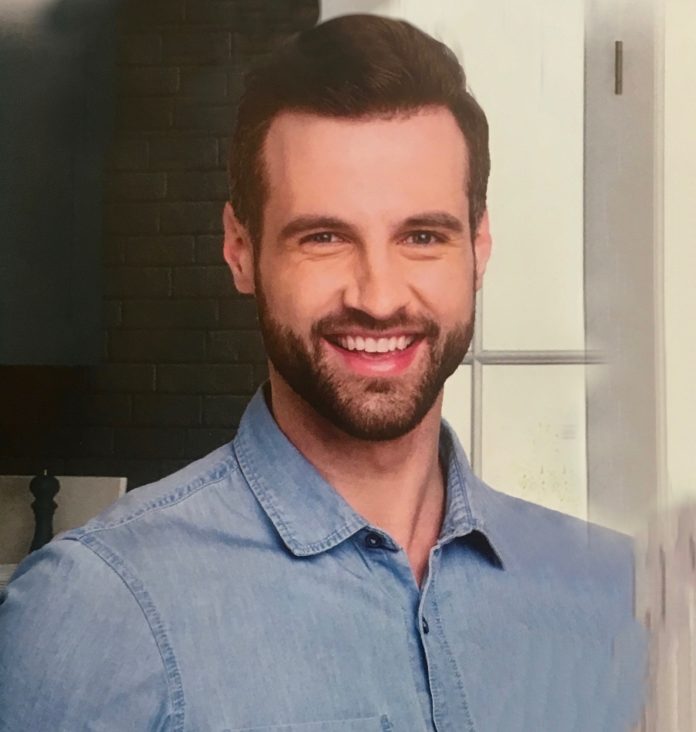

Hey there, I’m Dan. Growing up, my parents never taught me how to manage my finances. In fact, they spent most of their time at home arguing and worrying about their ownfinances. I went to school of course, but I was never taught how to be a responsible adult. Unfortunately, I got into a bleak situation that I thought would never get out of. Here’s my story.

It all started after I got out of high school and like most, I was told I needed to go to college so I could get a degree and a good job. Sounded simple enough, except that I had to pay for it myself. Luckily it was pretty easy to get a student loan from the government, and it was huge relief to not have to worry about money. College was awesome; I had the best time of my life. I graduated with a BA in business management, a girlfriend, and over $40K in debt. Little did I know that the fun was about to end.

It seemed impossible to find a job with no real work experience. And the jobs I did find paid barely enough to cover rent and bills, let alone going out on the weekends or paying off my student loan. I was pissed. So, if I needed something, an Xbox, a new phone, a trip with my girlfriend, whatever – I just put it on a credit card. Easy! I mean, that’s what people did, right? It didn’t seem like a big deal. I would literally just go buy whatever I wanted because the credit card felt like I had money in my pocket. $600 for an iPad seemed reasonable because I could afford it, as long as I was able to pay it off over time. It was just another monthly payment along with rent, bills and my student loan. Life felt simple again and I was totally happy. Even my apartment was run by a management company that allowed us to pay rent with a credit card. Another jackpot!

Well, before I knew it, I hit the limit on the card. I was paying the bill every month, but just the minimum balance. In fact, my regular payments made me a great candidate to all the credit card companies, and it was super easy to get another one. And then another, and another. I had no idea of the snowball that was building. Remember when I mentioned that school doesn’t teach you about finances? I can tell you right now that if we are taught anything at all, it should be how credit cards work – how they make their money off of us. I was spiraling out of control and didn’t even realize it.

Cut to a couple years later: I was laid off from my job, my girlfriend and I broke up, and I had three maxed-out cards with 29.99% interest rates due to late payments. The government put a garnish on my wages because of my student loan, I was using a gas card to buy food and toilet paper, and I sold stuff on eBay when I couldn’t borrow money from my parents. I stopped answering my phone and opening my mail because it was always either a bank or a collection agency. I even owed money to my own checking account due to a bunch of overdraft charges. I was in a permanent state of anxiety and I felt like a pathetic loser.

A couple months later while I was on my way back from an errand (I had just deposited a $500 check from my parents in my bank) I ran into a girl I knew from high school. I invited her to out to lunch so we could catch up, and when it came time to close out the bill, you guessed it, my card declined – the check hadn’t cleared my account yet. I was super embarrassed because I literally had no other way to pay. I had to tell her what was going on.

Turns out, she had been in similar, but even worse financial situation. She paid the bill, then told me her story:

She, too, was paying for college herself, but her future looked bright. To help out with money she had a job at a restaurant waiting tables. She randomly broke her ankle rollerblading one weekend and was unable able to continue working. She received disability checks, got addicted to painkillers and stopped showing up to her classes. She racked up over $28K in credit card debt and personal loans, eventually dropped out of school and had to move back in with her parents. Her days were reduced to a depressing blur of social media, watching all her friends live out their bright futures. She, too, felt pathetic. I could relate.

She happened to see an ad for a debt relief company one day, and out of curiosity and desperation, she clicked on it. She called the number on the site, talked to an agent for a while, and 3 years later she was completely out of debt.

I was super encouraged after hearing her story. But I learned my lesson about going blindly into any anything having to with money, so I decided to do my own research first. I was relieved to learn that the debt relief industry, much like the mortgage industry, is regulated by the Federal government to protect consumers from fraud. After a bunch more research online, I finally decided to reach out to one of them myself. They laid it all out for me – how much I owed, what debt they could help me with, what I was potentially going to pay, and my monthly payment to them. They also told me how they were getting paid. Everything was totally transparent. I felt hopeful for the first time in years.

Cut to my life now, 23 month later: I have a job, money in the bank and I’m paying off my student loan. But most importantly, I’m officially out of credit card debt. Turns out, being in control of my finances was what I need to be in control of my adult life. I definitely learned that the hard way.

If you’ve read this far, chances are you can relate to my story. Like my friend helped me, I hope sharing my experience will help you pay off your debt like boss, too.

– Dan

Here are some of the links I found helpful:

FTC Consumer Debt Info

Better Business Bureau

National Debt Relief (FYI I chose them because they’ve been around the longest, they have an A+ rating with the Better Business Bureau, and they have the best consumer reviews)